Post Merger Integration (PMI) | a planned action to successful deal

Mergers & Acquisitions - The Global Perspective

Mergers and acquisitions are used for improving competitiveness of companies and gaining competitive advantage over other firms through gaining greater market share, broadening the portfolio to reduce business risk, entering new markets and geographies, and capitalizing on economies of scale etc. Corporates worldwide have been aggressively building new competencies and capabilities and going in for markets based diversification leading to increase in number of mergers and acquisitions globally. In the USA, since the early 1900s, there have been six distinct waves of mergers and acquisitions, each with its distinct characteristics and outcomes. At the beginning of the twentieth century there was a drive for market share, followed three decades later by a longer and more ambitious wave as companies connected together different elements of the value chain, from raw materials and production through to distribution. The most recent wave, which started in 2004 after the internet bubble at the turn of the century and the subsequent downturn, is driven by consolidation motives. [Source of information - Boston Consulting Group (BCG) Report 2007].

Mergers & Acquisitions | The Indian Perspective

India has emerged as one of the top countries with respect to merger and acquisition deals. Indian companies have been actively involved in mergers and acquisitions in India domestically as well as internationally. The value share of deals where India has been a target or an acquirer has risen sharply over the past decade, from $2.2 billion in 1998 to $62 billion in 2007[For the years 2008 and 2009 the total value of deals is $ 25.billion and $12.50 billion respectively]. As India increases its participation in M&A deals, it is instructive to compare the domestic and cross-border acquisitions due to their distinctiveness. The distinction between them is a function of the change in market integration which changes the costs and benefit structure and also the difference in synergies social, cultural and organizational.

In India, the concept of mergers and acquisitions was initiated by the government bodies. Some well known financial organizations also took the necessary initiatives to restructure the corporate sector of India by adopting the mergers and acquisitions policies. The Indian economic reform since 1991 has opened up a whole lot of challenges both in the domestic and international spheres. The increased competition in the global market has prompted the Indian companies to go for mergers and acquisitions as an important strategic choice. The trends of mergers and acquisitions in India have changed over the years. The immediate effects of the mergers and acquisitions have also been diverse across the various sectors of the Indian economy. Among the different Indian sectors that have resorted to mergers and acquisitions in recent times, telecom, finance, FMCG, construction materials, automobile industry and steel industry are worth mentioning. With the increasing number of Indian companies opting for mergers and acquisitions, India is now one of the leading nations in the world in terms of mergers and acquisitions.

Till recent past, the incidence of Indian entrepreneurs acquiring foreign enterprises was not so common. The situation has undergone a sea change in the last four-five years. Acquisition of foreign companies by the Indian businesses has been the latest trend in the Indian corporate sector. There are different factors that played their parts in facilitating the mergers and acquisitions in India. Favorable government policies, buoyancy in economy, additional liquidity in the corporate sector, and dynamic attitudes of the Indian entrepreneurs are the key factors behind the changing trends of mergers and acquisitions in India. A survey among Indian corporate managers Grant Thornton found that Mergers & Acquisitions are a significant form of business strategy today for Indian Corporates. The main objectives behind any M&A transaction, for Corporates today were found to be:

- Improving revenues and profitability

- Faster growth in scale and quicker time to market

- Acquisition of new technology or competence

- Eliminate competition and increase market share

- Tax shield and investment savings

Post Merger Integration A significant element to a successful deal

As per the survey conducted by mergermarket commissioned by Merrill Corporation to survey 100 corporate from the Asia Pacific, European and North American region in the second quarter of 2009 regarding the foremost post merger integration issues facing deal makers today. Integration issues are always fundamental; the majority of respondents (53%) expect post-merger integration issues to be examined more closely than other factors in distressed mergers, which are likely to be especially high in volume in the current scenario of economic downturn continues to impact all sectors especially in Europe and USA. Respondents explain that integration must be closely monitored in these transactions, as the companies involved often merge unwillingly and

may not necessarily have a shared vision. Additionally, respondents cite future financial performance, future operational performance and potential cultural conflicts as three factors that are crucial to a mergers success but particularly hard to predict. These benchmarks are likely to become increasingly difficult to measure in the year ahead as many companies in the current market face a largely uncertain future. Over the course of time, post-merger integration will continue to be a vital component of the M&A process. In uncertain economic conditions, the process will undoubtedly take on greater significance as companies health or survival often depends on a successful merger. Amongst other aspects the certain basic questions shall be addressed immediately for building an approach to the activity of post merger integration. As per the survey the response to the following issues were as follows

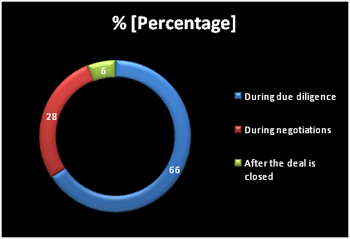

At what stage in the M&A process do you typically begin planning for post-merger integration?

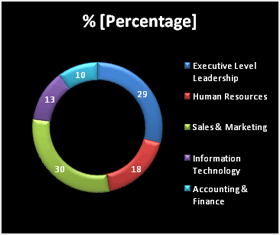

In which of the following departments is the integration process most complex?

Post merger Integration | Broad areas for integration

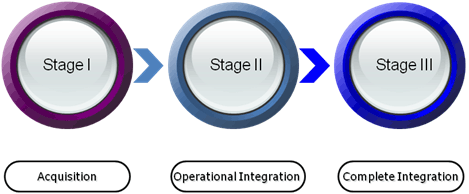

In the realistic sense there are three broad areas of integration namely -

- Finance where the objective is to attain the planned synergies [Click to view more details]

- Human Resource with the objective of harmonizing the culture through effective communication [Click to view more details]

- Legal with the objective of ensuring smooth sailing within the legal framework [Click to view more details]

Post merger Integration Finance

A business is acquired when it provides the buyer with synergies through

- Operating leverage

- Financial leverage

- And tax efficiencies if any.

Hence integration of finance and accounting is mainly to attain the planned synergies i.e. put the plan into action. This would require compromise, adjustments, reshuffle, retuning, compliance, etc from both transacting and outside entities.

The finance integration is approached into following stages

Finance - Acquisition

The Acquisition stage also termed as the �pre � integration� addresses matters relating to mode of consideration and acquisition. Mode of consideration is purchase of business in cash, shares or any other financial instrument. Further the mode of acquisition refers to purchase of business through a special purpose vehicle, group holding or the subsidiary. Acquisition is influence by primarily two factors �

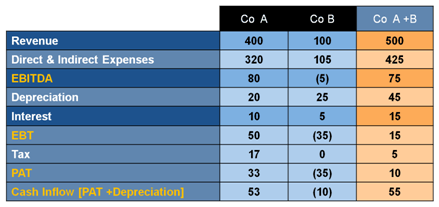

- Commercial � the break even post which the planned synergies would be crystallized. The trade off therefore is between the cash flows generated and the impact on the bottom line due to the synergy. Consider an example of a loss making business but a potential for growth in the foreseeable future.

As is evident from the example though post integration the cash flows has increased by 4% roughly bottom line i.e. PAT has declined considerably by 70%. This impact would be felt on the EPS and the market capital in case of the listed entity.

Therefore an immediate integration of the acquired business cannot be considered as a viable option and until the trade on the bottom line is equal to or higher than the cash flow gain.

- Financial the optimum way for utilization of funds of the group. Consider an example where the group holding company can borrow at 6% where as its subsidiary contemplating acquisition can borrow at 12%. Now either the group can raise the equity in the subsidiary through borrowed funds and enable to latter to acquire the target entity or where the group does not want to further increase its holding in subsidiary then it may evaluate the opportunity for leverage buy out such that its effective cost of borrowing is 6% from 12%.

Finance Operational Integration

This stage also termed as In process Integration refers to identifying functional areas for integration without affecting the ongoing operations of the buyer and the seller. In other words it addresses taking active steps that are reversible without any permanent impact on the business of the transacting parities. The approach to this stage is better understood by considering the functional areas that may differ across sectors. For instance in a manufacturing concern functional areas are treasury, procurement, production and sales & marketing which is inclusive and not exhaustive. In process integration in these areas would have to be approached as follows

- Treasury -

- Transfer of existing external loan funds to attain optimum cost of borrowing

- Renegotiation with the lenders for the terms and conditions of borrowing e.g. repayment schedule

- Searching for entirely new avenues with the objective of optimum cost, repayment, security and other terms and conditions.

- Explore the possibility of eliminating cost of forward cover where either the buyer or the acquired entity is exposed to import payment and the other to export receipts

- Procurement -

- Common supplier be negotiated for higher bulk discount

- Different suppliers be evaluated for higher bulk discounts

- Negotiation for terms of payment with the single supplier

- Reshuffle of existing suppliers to attain higher savings in logistic costs. E.g. the buyer is sourcing supplies to its units at different location from the single unit of its supplier may now evaluate sourcing from the supplier of the acquired entity situated in proximity to the buyers units.

- Sales & Marketing

Reshuffle of customers to achieve product cost, timeliness and logistics efficiencies. E.g. Customer of the buyer would be supplied by the target entity production unit situated in proximity to such customer leading to change in the bottom line of the acquired and the acquired entity

- Production

Change in product mix in pursuant to reshuffle of suppliers, customers, logistics and production efficiency. E.g. the target entity may commence producing the type of product for the customer of the buyer situated in proximity to the target entity that may result in larger impact favorable or adverse on the bottom line of the acquiring and the acquired entity.

Finance Complete Integration

This stage also termed as Post Integration refers to an irreversible long term permanent decision that aims at achieving in creating a new identity for both the buyer and the target entity. It is the end action undertaken to achieve total integration as a single identity with regard to

- Finance - Internal

The in process integration dealt with financial integration of external sources but this stage deals with financial integration of internal sources e.g. establishing the transfer pricing of goods and services between the acquiring and the acquired entity or amongst division.

- Accounting

Integration from the accounting angle requires merging of financials within the existing regulatory framework and with the view to prevent the direct impact to the shareholders value. For instance in case of merging of the subsidiary into the holding the brought forward losses be knocked off against the

Free reserves or business reconstruction reserve of the merged entity without impacting the current years profits and thereby the shareholders value of the transacting entities. Hence the choice of method of accounting for amalgamation plays important factors to amongst other aspects decide the impact on the shareholders value. Apart from the above integration would also require the following secondary steps from the accounting angle

- Integration of accounts with different year endings and accounting policies

- Redefining Management Information Systems

- Retuning internal controls undergone change due to changes in size, hierarchical structure of organization and technology

HU will provide the best services relating to Post Merger Acquisition (PMI) to you which will help you to convert your deal into successful merger. Kindly click here to contact us

Post merger Integration � Human Resource

Human Resource - Introduction

The past decade has seen a spurt in M&A activity buzzing across boardrooms. Acquisitions were evaluated in terms of synergies, cost savings, increase in market share etc with investment bankers rolling out figures justifying valuations. In spite of all this home work nearly 75-80% of the mergers fail. Substantiated synergies and figures do a vanishing job. If companies go through a detailed analysis and due diligence review in all areas- business, markets, financial, legal etc., then what is it that is pulling down companies in achieving the expected level of success?

- Statistics have proved that one of the major reasons for M&A failures is the human resource management. Companies that failed to realize the importance of HR integration in an acquisition have definitely not been able achieve their merger objectives. Moreover poorly managed HR integration can kill the company! Recently Piramal Hhealthcare sold its healthcare division to Abbot Labs. Piramal Healthcare believed that its workers helped in creating value for the company. The company declared a bonus payment to its employees including the employees of the outgoing division. This signifies the importance that Piramal gave to HR issues in the sale transaction in order to prevent any dissent or dissatisfaction from the employees of the outgoing division.

HR integration forms the greatest challenge in any M&A transaction. They have to play a critical and strategic role to achieve post merger.

HR integration forms the greatest challenge in any M&A transaction. They have to play a critical and strategic role to achieve post merger.

Around 50% to 80% of the mergers fail because of:

- Inability to integrate people in the new entity

- Inability to integrate cultures

- Attitude problems

- Lack of commitment

- Lack of problems

- Lack of trust

- Poor morale

The various issues that arise in HR integration can be understood as follows:

- Top Management Combination: Integrating top management to lead and achieve the future organizational goals is a sensitive issue since realistically all cannot be accommodated. The challenge is to retain the desired talent for the merged entity and deal with departing people quickly and effectively.

The practical issue here is that political reasons often dictate that individuals are required to fill certain roles, which means an objective, competency-based selection process may be difficult to achieve. However the long-term benefits of a thorough and objective leadership selection process far outweigh the advantages of a politically-correct leadership appointment.Top management is critical for organizational success. It is necessary to retain key people as they also have a group of people who are committed and attached to them. If these key people are not retained then it would also involve losing the people who worked in their team. A very good example is PWC where after the Satyam scam many key employees including partners moved on to other Big Four firms and also took their team along with them.

The practical issue here is that political reasons often dictate that individuals are required to fill certain roles, which means an objective, competency-based selection process may be difficult to achieve. However the long-term benefits of a thorough and objective leadership selection process far outweigh the advantages of a politically-correct leadership appointment.Top management is critical for organizational success. It is necessary to retain key people as they also have a group of people who are committed and attached to them. If these key people are not retained then it would also involve losing the people who worked in their team. A very good example is PWC where after the Satyam scam many key employees including partners moved on to other Big Four firms and also took their team along with them. - Some issues to be considered:

- What criteria will be used to choose the new management team and when will names be announced?

- Which executive positions are expendable?

- Will the existing team be augmented by external managers (in order to foster restructuring efforts)?

- How can top performers at the target company be identified early on and their commitment to the new company secured?

- Which areas are likely to face particularly strong resistance from management?

- Development of vision and mission:

- The development of a corporate vision is not as easy as one might think. A merger without a clear and realistic vision may lead to similar negative results in terms of shareholder value as merger based solely on fit-approaches may do. Visions are borne from good ideas, often developed by visionary people in endless meetings and projects. The problem is that many ideas look promising at the first sight, but prove to be useless later on.Stakeholder Group Experiences problems and resistances because of lack of vision and mission sharing

Members of board of directors Of Target Company Fear of a dominating Acquirer

Fear to loose the own position as CEO

Conflicts in allocation of responsibilities and tasks

Conflicts in location of new headquarter

Personal hostility among CEOs of both partners

Conflicts because of higher claims for redundancy paymentsMembers of Supervisory Board Fear of a dominating merger partner

Fear to loose seat in the Supervisory Board

Conflicts in name of the merged bank and location of the new headquarter

Problems with regional / local politics

Interest in regional independenceStaff Conflicts due to fear of changes in the middle management and among the all staff

- The development of a corporate vision is not as easy as one might think. A merger without a clear and realistic vision may lead to similar negative results in terms of shareholder value as merger based solely on fit-approaches may do. Visions are borne from good ideas, often developed by visionary people in endless meetings and projects. The problem is that many ideas look promising at the first sight, but prove to be useless later on.Stakeholder Group Experiences problems and resistances because of lack of vision and mission sharing

- Redefining and not summation of organizational goals:

- Summation of individual goals of the merging entities would certainly result in a disaster since the merging entities post merger would pursue its predefined goals. Defining common organizational goals of the merged entity is the first step in HR integration to provide a clear cut direction to the merged entity the course of action to be adopted post merger which in turn is based on the objectives for which the deal was executed.

- Dovetailing employees: The uncertainties of M&As shift the focus of employees from productive work to issues related to interpersonal conflicts, layoffs, career growth with the acquirer company, compensation, etc. Moreover, employees are concerned with how well they will go with new colleagues. The mergers involve downsizing, hence the first thing that comes to the minds of employees is related to their job security. Mergers also lead to changes in the well defined career paths of employees, as defined by the acquired company. Due to these reasons, employees find themselves in a completely different situation with changes in job profiles and work teams. This may have a negative impact on the performance of the employees.

- Cultural Integration:

- Culture consists of the long-standing, largely implicit shared values, beliefs, and assumptions that influence behavior, attitudes,

and meaning in a company (or society).Culture has emerged as one of the dominant barriers to effective integrations. An organization's culture defines its managerial style, structure and organizational practices. Each company has its own set of values which may conflict with those of the acquired company. Imagine play-at-work culture Google tying the knot with IBM buying Google? The 'suit' culture of IBM will not at all jell with the casual approach that Google has, and a merger of this sort would fail miserably. At the time of short listing of target it is very necessary to understand the culture and HR structure of the acquiree company. The organization has to assess as to whether successful integration of people and culture would be possible. For example before ICICI bank, HDFC Bank had considered merger with Bank of Rajasthan. However before it could assess the commercial and financial viability, HDFC bank management could not see a successful integration of people and culture of the traditionally run Bank of Rajasthan. Moreover even now after ICICI has decided to merge BOR with it there still seems to lot of friction from BOR employees who fear they would not be able to adapt themselves into the professional ICICI bank culture. The follow table indicates how cultural mismatch can affect your organization.

and meaning in a company (or society).Culture has emerged as one of the dominant barriers to effective integrations. An organization's culture defines its managerial style, structure and organizational practices. Each company has its own set of values which may conflict with those of the acquired company. Imagine play-at-work culture Google tying the knot with IBM buying Google? The 'suit' culture of IBM will not at all jell with the casual approach that Google has, and a merger of this sort would fail miserably. At the time of short listing of target it is very necessary to understand the culture and HR structure of the acquiree company. The organization has to assess as to whether successful integration of people and culture would be possible. For example before ICICI bank, HDFC Bank had considered merger with Bank of Rajasthan. However before it could assess the commercial and financial viability, HDFC bank management could not see a successful integration of people and culture of the traditionally run Bank of Rajasthan. Moreover even now after ICICI has decided to merge BOR with it there still seems to lot of friction from BOR employees who fear they would not be able to adapt themselves into the professional ICICI bank culture. The follow table indicates how cultural mismatch can affect your organization.

AREAS IMPACTED BY CULTURE OUTCOMES Work culture Sudden change in work culture may face resistance & discomfort Different decision making styles Can result in slow decision making process Leadership style A sudden change in leadership style may affect employee turnover especially the top level people Resistance to change No initiative to introduce new strategies Personal success vs Team success Differences and dislike among employees and lack of support from other for getting the work done The employees may not be able to accommodate themselves in a new culture and thus may lead to cultural shock. Inability to adapt to a new culture increases stress levels among employees and results in low job performance. When it comes to cross-border M&A care should be taken to see that the national cultures of the two companies are not drastically different. The need therefore is to follow a structured approach in dealing with cultural differences.

- Culture consists of the long-standing, largely implicit shared values, beliefs, and assumptions that influence behavior, attitudes,

- RESOLVING CULTURAL ISSUES

- As early in the process as possible, announce the alliance explaining why, why now, and anticipated steps. Keep communications regular, frequent and clear throughout.

- Do a bicultural audit to find common ground and difference.

- Agree on and communicate an exciting new vision to focus people on the future and help them let go of the past.

- Set up bicultural task forces on pertinent topics such as R&D, Quality, Communication and Marketing.

- Provide language training, promote cross-cultural dialogue and train multicultural teams in Culture bridging skills.

- Get commitment from Top Management to participate actively in communications and training programs from the beginning

- Increase social contact and ensure nationality mix.

- Set and communicate acceptable performance criteria for evaluation of management performance.

- Promote internal transfers and short term staff exchanges internationally

- Ensure you have an international organizational structure to support your international strategy.

- EMPLOYEE COMMUNICATION:

- Whenever there is news of any merger in an organization, anxiety prevails among the employees. This atmosphere of apprehensions leads to company wide rumors. The employees lose faith in their organization and tend to become demotivated. To free employees from such fears, proper communication has to take place between the management and the employees. The management should instill a sense of security among them. Attrition: Most mergers bring with them downsizing, reallocation of work, change in work profiles, changes in career paths, etc. Moreover apprehensions about the new company also create anxiety among employees. If they fail to adopt to the new culture they face high levels of stress and thus end up leaving the organization.The following areas need to be addressed:

- o What communications strategies have been implemented to ensure the integrity and accessibility of information across all levels of the organization?

- What are the main concerns of the employees?

- How can messages be formulated to address employee concerns?

- What media are most appropriate for various messages and target audiences?

- How can negative impacts of events such as transfers, staff reductions or demotions be reduced?

- How should internal communication programs be orchestrated and coordinated with other activities?

- Organizational Structure: Another problem is the difference between the organizational structures of the companies. Since the organizational structures are different, differences in compensation packages and designations can take place. The company has to maintain employees at equal levels. Unable to do so, employees can feel dissatisfied. The following issues need to be addressed:

- How will the selected organizational changes affect staffing requirements?

- What should be the timing of the organization and staffing changes? Who should be responsible for them?

- What functions are duplicated and might be areas for replacement/ reassignment of talent?

- What areas of corporate knowledge/expertise need to be protected?

- Other Issues: The following questions need to be addressed

- Do employees feel integration is proceeding smoothly? If not, why?

- Can they recommend ways to expedite or facilitate the process? Are efforts being made to mitigate the "us vs. them" mentality?

- If there have been layoffs, for example, do the employees who have been maintained feel confident in their current standing and future prospects? How do they feel about the fact that there were layoffs (e.g., do they harbor resentment toward management)?

- Are remaining employees more likely to follow their key influencers out the door, or have they been given compelling reasons to stay?

- Do they feel there has been an equal distribution of responsibility granted to managers from both of the merging companies?

- Do they feel there has been inequality in which one firm�s employees got the "plum" assignments or territories?

- Do acquired employees feel like second-class citizens? In general, do they feel both sets of employees are being treated fairly?

- Do employees understand what will be expected of them in terms of specific new job responsibilities, as well as how they will be evaluated?

- Do they understand what criteria will be used in the appraisal process, and when promotions and salary increases will be granted?

- Do employees know how the merged firm is structured, who the key executives are, and how the lines of reporting are set up?

- Do they understand how the merged company runs on a day-to-day basis (e.g., in terms of purchasing procedures, time and expense reporting)?

- Do employees fully understand their new benefits and the provisions of the company�s health and welfare programs? Do they know how to file health insurance claims? Do they fully understand the particulars of the company�s retirement plans?

- Do employees understand the reason for the transaction and the strategic direction of the merged company � including how it is positioned in the marketplace vis-�-vis competitors?

- Do they understand what customer-service or -relations roles employees play at different levels of the organization?

- Whenever there is news of any merger in an organization, anxiety prevails among the employees. This atmosphere of apprehensions leads to company wide rumors. The employees lose faith in their organization and tend to become demotivated. To free employees from such fears, proper communication has to take place between the management and the employees. The management should instill a sense of security among them. Attrition: Most mergers bring with them downsizing, reallocation of work, change in work profiles, changes in career paths, etc. Moreover apprehensions about the new company also create anxiety among employees. If they fail to adopt to the new culture they face high levels of stress and thus end up leaving the organization.The following areas need to be addressed:

HOW CAN HR ISSUES BE RESOLVED

- HR Due Diligence

A due diligence review helps the merging companies identify the presence of any hidden liabilities for the integrated business. This review would help the companies have a re-look at their decision and recheck its feasibility. It would also help the companies identify those critical areas which need immediate attention if the deal is to be carried out successfully. The common belief is that HR does not have any role to play during the due diligence review. But is it true?It happened in some of the mergers that the companies failed to take note of the resentment brewing in the employees and by the time they realized it after the merger came through, more than half the workforce had left the integrated organization. HR due diligence review is one of the concepts that has come of age in the recent times. Some organizations are even looking at specific issues like "culture due diligence review". Some of the components for the HR due diligence review are:- Organizational culture and structure

- Employee compensation & benefits

- Industrial relations

- Pending employee litigations

- HR policies and procedures

- Key talent analysis

- ROLE OF HR IN MAKING M&A SUCCESSFUL

The success of a merger and acquisition depends on how well an organization deals with issues related to its people and cultural integration. The HR department of an organization act as a strategic partner. So formulating strategies while ignoring the employees can be critical for the organization. The role of HR becomes strategic when it takes decisions about what kind of people, capability and commitment the company would want after the deal. To efficiently handle this phase many companies undertake feasibility studies based on which it decides what part of the workforce is to be retained. The HR can help the employee in the following ways:- HR helps in managing interpersonal conflicts and makes employees better team players. It also helps them in dealing with cultural differences. Clear communication content and channels are customized to address cultural differences.

- HR also deals effectively with the integration issue. Effective employee communication acts as a key here. Questions about job security, relocation, changes in benefit programmes and new reporting relationships are answered by the HR only. Keeping a check on rumors, anxiety, resentment and the loss of top talent, has also to be dealt with.

- The M&A phase is very sensitive for employees as they feel insecure about their future in the transitional times. HR in such a situation makes people retain their faith in the organization. The HR has to retain the confidence of employees and assure them job security.

External integration

In many cases of integration companies become so focused on attaining synergies that they stop paying attention to integrating customers and retaining them.

Therefore, it is decisive to fully engage customers and get their feedback about the integration. Companies should create an intelligence mechanism to learn what is going on in the marketplace. It is extremely important to actively listen to the voice of the customer. Tales of post-merger woes, ranging from workforce issues to integration hiccups, make for recurring headlines. But the loss of customers in the wake of a deal can be the most difficult blow to stomach � especially when customer synergies have been touted as a driving force behind the transaction, as is often the case. When a customer leaves, revenue leaves with it. When millions of customers leave, management often follows. Projections of a post-merger customer base are often overly rosy. Customer reactions can be difficult to gauge, and business relationships are often based on a combination of tangible and intangible factors. With this level of uncertainty, customer preservation strategies must be a top priority throughout the merger process. If executed properly, such strategies can not only mitigate risk, but can also pave the way for future revenue enhancement opportunities.

How to deal with customer related issues

Know your customers:

The first step in the process is to make realistic assumptions about the potential for customer loss by conducting a detailed analysis of both companies� customer bases. Who are the key customers? Where is there overlap? Which are stable? What are the customers� sales histories? Which are profitable and unprofitable? Which are at-risk?

Communication

The importance of communications in mergers and acquisitions cannot be overstated. From a customer perspective, the way in which a company manages its business relationships during a period of transition can be the difference between preserving and losing relationships. Like employees, every customer will want to know what the merger means for him or her. An employee will wonder, �Will my primary contact change? Will the company continue to offer the same types of products and services? Will I continue to receive what I need on time?� In addition, competitors may use the opportunity to take advantage of the situation, attempting to recruit top talent or take away business.

Any corporate employee who interfaces with customers must be equipped to explain the impact and benefits of the merger and how business will continue to operate. This will help to establish a clear and consistent message, and that accurate information is being disseminated. A specific plan must be put in place for communicating proactively and directly with customers. In some cases, it may make sense for management and/or key sales people to make personal visits to key customers. In others, it may be more appropriate to conduct personal or conference calls and/or disseminate a written communication in the form of an email or formal letter. The timing and messaging must be carefully coordinated with all external announcements while the initial communication with customers is clearly the most critical, the process of providing frequent information and updates must continue over-time � in some cases for years after the merger has taken place. Integration is not a process that takes place overnight.

Post merger Integration � Legal

There are numerous legal compliances, critical in nature, which has to be addressed by the entities transacting acquisition. Depending upon legal intricacies involved in the structuring, there can be various effects of the legal implications on the post merger scenario. It could be in form of increased in compliance cost or reaping benefits of favorable enactments or even a failure for the entire scheme. A restructuring activity is carried with the vision to create better value for the organization and the people connected with it, in most cases. A single wrong step on legal ladder can prove disastrous for the whole process. A diligent check of all relevant enactments shall be carried to avoid undesired events.

It is a proven over a period of time that business restructuring may bring tremendous value to the enterprise, but nothing comes without a price tag. One needs to take care of all legal, financial, human resource and other aspects even small in nature to make it a success. Talking in strict legal context, there are as good as 27 laws which directly hit the acquisition process at one or another stage of it. As every organization would definitely take proper step to make the legal part sure, the article strive to discuss some of the crucial facets of significant enactment, bearing the post merger integration.

Corporate Laws

AS general perception, the approach to corporate law is more of compliance oriented, to ensure the smooth approval for the merger. But there are provisions, in corporate laws which put a check on the organization, in the post merger scenario.

FII limits under merged entities:

Under Regulation 7 of FEMA 2000, once a scheme of merger, demerger or amalgamation has been approved by the court, the transferee company (whether the survivor or a new company) is permitted to issue shares to the shareholders of the transferor company who are persons resident outside India, subject to the condition that the percentage of non resident holdings in the company does not exceed the limits for which approval has been granted by the RBI or the prescribed sectoral ceiling under the foreign direct investment policy set under the FEMA laws. If the new share allotment exceeds such limits, the company will have to obtain the prior approval of the FIPB and the RBI before issuing shares to the non residents.

Competition Act

The competition Act uses a composite expression � combination to cover different modes, viz. merger, acquisition of shares, assets, acquiring control of an enterprise. The objective of any competition law is to ensure that persons or enterprises obtaining the autonomy through merger or acquisition do not impair the structure of competition.

What bothers the Post merger scenario is provision of Section 20(1) of the Act, where the CCI (Competition commission of India) can inquire into any combination, suo moto or upon receiving information, within one year from when such combination takes effect. The pre-notification option granted to enterprises under Section 6(2) and the power of the CCI to inquire suo moto under Section 20 may lead to an anomalous situation, since companies that do not exercise their option under Section 6(2) are not automatically exempt from the investigations of the CCI.

The threshold limits:

The limits are more than Rs 4000 cr. or Rs 12000 cr. and US$ 2 billion and 6 billions in case merged/amalgamated entity belongs to a group in India or outside India respectively

The limits are more than Rs 4000 cr. or Rs 12000 cr. and US$ 2 billion and 6 billions in case merged/amalgamated entity belongs to a group in India or outside India respectively

For e.g. Company �A� acquires company �B.� A and B do not consider their transaction anti-competitive even though they have an asset value and turnover above the prescribed threshold limit. The two companies do not notify the CCI about their merger. The companies invest a large amount on their merger within the first six months. The CCI on receipt of information from a competitor carries out an inquiry and passes a judgment within one year of the merger, that the merger has an adverse effect on competition and should not take effect. In this case, the two merged companies will incur huge losses as a result of the CCI�s order. This inconsistency can be removed by making pre-notification of combinations mandatory for all enterprises that have the prescribed asset value and turnover.

As the investigation would be pending with CCI in an adverse case, it will create many uncertainties. The uncertainty has several implications, including the following:

- Perception among customers

- Uncertainty as regards the �identity� of the enterprise could create reluctance among customers, who could choose to shift to a more �stable� competitor.

- Strategic and operational business decision could remain in �limbo�.

- Human resources: This has dimensions relating to alignment of titles, roles and responsibilities. A long period of uncertainty could seriously dent morale and heighten attrition.

- Enterprise value(s): As a result of the uncertainty, including the above factors, the market value of both enterprises could be severely dented due to the long period of uncertainty.]

Tenancy Act

In an amalgamation under Section 394 of the Companies Act, 1956, the court has been given vast powers as a result of which the order of the court sanctioning the amalgamation results, without further act or deed, in the transfer of the assets and liabilities in the business undertaking being transferred. In other words, the transfer does not require the permission of each of the parties, so long as the prescribed procedure is followed. In this background, the question that arises is that when the tenancy is practically an asset of the company and when land and buildings could be transferred without further act or deed, can tenancy be also so transferred. More importantly, will the landlord's permission not be required for such transfer.

The answer is in the negative. The legal requirement of taking the permission of the landlord is necessary to be complied for the transfer to be effective. If the transfer is made without such complying with such legal requirement, the landlord can evict the tenant even if the court had sanctioned the scheme in which it was clearly stated that the tenancy would be transferred along with other assets and liabilities. The reason for this is simply that the court while sanctioning such a transfer of undertaking has no powers to override the provisions of the state laws relating to tenancy.

It must be said that transfer of tenancy imposes an important hurdle towards post merger integration process. The solution for this, considering that tenancy laws are state laws, is not easy. While much can be said for and against tenancy laws in general, some amendments need be made if restructuring transactions are to be encouraged.

Duties and Taxes

Duties and taxes plays a significant role in structuring strategy, as they bear direct effect on the cash flow and the bottomline of the entity post merger.

Indirect Tax

Impact on Inputs/Work in progress

As on the appointed date, the transferor company may have credit lying either in stock or in work in progress. Under such circumstances the credit has to be transferred to the transferee company. However, the credit shall be allowed only if the stock of inputs or work in progress is also transferred along with the factory to the new site o ownership and the inputs on which credit has been availed of are duly accounted for to the satisfaction of the Tax Dept.

Carry forward of credits

It is been stated that the transfer of CENVAT credit shall be allowed only �if the stock of inputs as such are in process, or the capital goods is also transferred along with the factory to the new site or ownership and the inputs or capital goods on which credit has been availed of.

The transferee company is entitled to avail of credit on the inputs which are to be used in the manufacture of final product after filing declaration. It is submitted that notwithstanding the changes in ownership the unit remains the same for all practical purpose for compliance with the excise formalities and therefore there is no restriction in availing excess credit.

The transferee company is entitled to avail of credit on the inputs which are to be used in the manufacture of final product after filing declaration. It is submitted that notwithstanding the changes in ownership the unit remains the same for all practical purpose for compliance with the excise formalities and therefore there is no restriction in availing excess credit.

Transfer from Backward area, SEZ, etc.

Where any undertaking being the Unit which is entitled to the deduction under THE SPECIAL ECONOMIC ZONES ACT, 2005 is transferred, before the expiry of the period specified, to another undertaking, being the Unit in a scheme of amalgamation or demerger, then no deduction shall be admissible to the amalgamating or the demerged Unit, being the company for the previous year in which the amalgamation or the demerger takes place; the provisions shall, as they would have applied to the amalgamating or the demerged Unit being the company as if the amalgamation or demerger had not taken place, & would be applicable to Amalgamated company.

Integrating undertakings/Factories

Where the plants/factories of the transacting entities are situated in same locality where they are attached via bridge or road or any other suitable means, they can be integrated in as one plant. If the output of one factory/plant becomes input for other one, than the transfer of material would fall into category of captive consumption and such transfer would be exempt from excise duty.

Stamp Duty

Dematerialization of shares of Pvt. Ltd companies:\

Before acquiring a private company, one can get its shares dematerialized with NSDL and CDSL. Where the private company�s Articles of Association does not contain provision for dematerialization, it has to be amended accordingly. This would save on the stamp duty on transfer of shares to be paid by the Acquirer Company.

No stamp duty for Holding � subsidiary marriage

The Central Government has exempted the payment of stamp duty on instrument evidencing the transfer of property between companies limited by shares as defined in the Indian companies� act 1913 in a case:

- Where at least 90% of the issued capital of the transferee company is in the beneficial ownership of the transferor company

- Where the transfer taken place between a parent company and a subsidiary company one of which is the beneficial owner of not less than 90% of the issued share capital of the other. Or,

- Where the transfer takes place between two subsidiary companies each of which not less than 90% of the share capital is in the beneficial ownership of a common parent company.

However stamp duty being a state subject the above would apply only in those states where the state government follows the above stated notification of the Central Government otherwise stamp duty would be applicable irrespective of the relation mentioned in the above said notification.

Income Tax

Integrate as separate company/SBU/Branch/Subsidiary?

While integrating the acquired entity, the legal format to be kept is one of the important issues from tax point of view. There are different implication different formats as follows:

As subsidiary:

Where the transferor company is an Indian company and kept as subsidiary, on integration the losses will be allowed to be carried forward and most importantly there will be no stamp duty obligation on transfer of assets.

But in case of cross boarder merger, if the acquired company is a foreign company and kept as subsidiary for integration, on integration carry fwd of losses will not be allowed to the Indian transferee company under Indian tax laws

As Branch:

Where the transferor company is integrated as branch, carry forward of losses will be allowed irrespective of whether the transferor company is foreign company or a domestic company. The effect of Branch�s operations is directly affected in the books of the acquiring company.

Allowances

- Scientific Research expenditure [Sec 35(5)]:

Where, in a scheme of amalgamation, the amalgamating company sells or otherwise transfers to the amalgamated company (being an Indian company) any asset representing expenditure of a capital nature on scientific research, the amalgamating company shall not be allowed the R&D expenses, The provisions of this section shall, as far as may be, apply to the amalgamated company as they would have applied to the amalgamating company.

But in case the resulted company has sold or otherwise transferred the R&D asset, than the expenditure would not be allowed. - Statutory dues paid after due date [Sec 43B]:

It is submitted that the amount paid on account of the statutory dues after the last date of the previous year or the appointed date would be deemed to have been paid on behalf of the amalgamated company and not by the amalgamating company. Even though theoretically this appears to be difficult, the provisions will have to be read in a reasonable manner, as the liability discharged would have to be treated as liability of the amalgamating company, even though as per the scheme, it is acting on behalf of the amalgamated company after the appointed date and it should be allowed.

Deductions

- Small scale industry issue:

In this context, the successor of business will be eligible to get deduction for the unexpired period. The difficulty is however, likely to arise in case the deduction is granted u/s. 80-HHA or 80-I/80-IB etc, on the basis of SSI status and if on amalgamation, it ceases to be SSI, then whether the amalgamated company will be able to claim deduction in view of the specific provisions of sec, 80HHA (3). Deduction u/s. 80-I, cannot be withdrawn even after amalgamation merely because it ceases to be SSI after amalgamation, if the deduction is otherwise allowable to the amalgamated company. - Deduction based on undertaking:

Another issue in this context that may arise is, whether deduction u/s. 80-IA/80-1B etc. would be on the entire profit of the amalgamated company (including profits of the other units of the amalgamated company) or only on profits of the amalgamating company (which has got merged) by treating it as a separate unit. It is felt that deduction u/s.80-I/80-IA/80-IB which is qua "the undertaking" and not the entire profits of the amalgamated company and therefore, will be restricted to the profits of the eligible unit only.Tax benefits U/s 80-IA not available to amalgamation or de-merger:

The provisions of section 80-IA provide for 100% deduction for ten years in respect of profits and gains of certain undertakings or enterprises engaged in the business of development, operation and maintenance of infrastructure facility, industrial parks and special economic zones or generation, distribution or transmission of power.

Earlier the benefit were available to amalgamation under Sub-section (12) of section 80-IA, but the union Budget 2007-2008 has inserted a new sub-section (12A) in section so that the provisions of sub-section (12) shall not apply to any undertaking or enterprise, which is transferred in a scheme of amalgamation or de-merger.